- industries

- / industries

- retail

-

/ retail

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- banking

- / banking

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- financial services

-

/ financial services

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

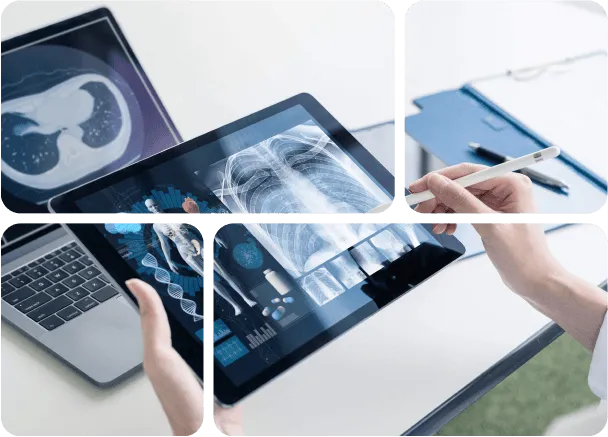

- healthcare

-

/ healthcare

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- hospitality

- / hospitality

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- foodtech

- / foodtech

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- manufacturing

- / manufacturing

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- publishing

- / publishing

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- real estate

- / real estate

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- telco

- / telco

In the intricate world of retail, mindit.io stands out as your strategic ally.

-

- services

- / services

- enterprise applications

- / enterprise applicationsOur enterprise applications integrate seamlessly with your existing systems, providing a unified solution.

-

- product engineering

- / product engineeringWe specialize in Software Product Engineering, transforming your concepts into impactful products.

-

- data & analytics

-

/ data & analytics

Data Analytics is where IT, statistics, and business converge.

-

- artificial intelligence

- / artificial intelligenceArtificial intelligence and machine learning: we can unlock business potential through automation within your organization.

-

- integration solutions

- / integration solutionsStreamline IT projects, reduce risks, and ensure on-time, on-budget technology deployment aligned with your business goals.

-

- maintenance & support

- / maintenance & supportSecure and reliable software performance with proactive issue identification and disaster recovery strategies

-

- cloud & infrastructure services

- / cloud & infrastructure servicesAchieve more with our tailored DevOps, cloud, and infrastructure services for smooth, efficient, and secure operations.

-

- / accelerators

- / acceleratorsOur accelerators are built to drive growth and enhance your organization’s capabilities.

-

- success stories

- / success stories

- retail

-

/ retail

A global retailer, with 2200 stores & 25,000 employees, had critical issues in its Java legacy web application.We facilitated a decision on how much to invest in novelty items for one of the world’s biggest retail players.

-

- banking

- / bankingPartnered with fin-tech to create an algorithm for tailored investment choicesMigration to TIBCO BW6: Key European bank tackled complex business logic & integrated components using ESB architecture.

-

- financial services

- / financial servicesCross-border payment solution for education, healthcare, and businesses worldwide.

-

- healthcare

- / healthcareSwisscom’s Medical Connector offers DICOM-standard data communication with no size limits for providers.

-

- hospitality

- / hospitalityPowertage Chat uses RAG to deliver fast, accurate answers to visitor and exhibitor questions.Developed a white-label app for 2023 Rugby World Cup, enhancing UX and expanding client expertise.

-

- foodtech

- / foodtechPlanteneers offers a virtual product catalog configuration experience.

-

- manufacturing

- / manufacturingWe Partnered for production boost, cost reduction, and quality. Our software maximizes efficiency & savings.

-

- publishing

- / publishingEnhanced Izzard Ink with automated royalties & AI manuscript analysis for improved efficiency.

-

- real estate

- / real estateEfficiency in Real Estate: Created a Customer Portal for owners 55+, providing secure equity release info access.

-

- telco

- / telcoDeveloping Telco Apps for one of the most dynamic telco companies from Romania.

-

- company

- / company

- about us

-

/ about us

The partner of choice for data & product engineering to drive business growth & deliver an impact within your organization

-

- product engineering

- / product engineeringWe specialize in Software Product Engineering, transforming your concepts into impactful products.

-

- technology

- / technology250+ specialists skilled in software, BI, integration, offering end-to-end services from research to ongoing maintenance.

-

- methodology

- / methodologyWe specialize in software product engineering, transforming your concepts into impactful products.

-

- careers

- / careersOur team needs one more awesome person, like you. Let’s grow together! Why not give it a try?

-

- do good

- / do goodWe’re a team devoted to making the world better with small acts. We get involved and always stand for kindness.

-

- events

- blog

- contact us

- / contact usWe would love to hear from you! We have offices and teams in Romania and Switzerland. How can we make your business thrive?

-

- / get in touch