While much has been explored about Time Series Forecasting algorithms in the context of Demand Forecasting, there is always room for a fresh perspective on the business impact it can bring to dynamic sectors like Retail and Consumer Goods. The potential for innovation in these sectors is vast and exciting to explore.

According to my experience, one of the most frequent mistakes businesses and organizations make in digital transformation is focusing too much on technology and putting the business vision on a second level. So many times, I have encountered CxOs and Executive Directors obsessed with listening exclusively to use cases already implemented by providers in other companies successfully. Once a use case has already been implemented by somebody else, it has lost its competitive and innovation edge. It is one step closer to becoming a commodity. Yet, simultaneously, the world is accelerating its transformative pace, and staying behind is a luxury that no company or organization can afford. Henceforth, one of the mighty compromises companies worldwide must make is to find the right balance between innovation risk-taking and commodity housekeeping.

Notwithstanding the established priorities, leaders and decision-makers must always choose to transform companies with the AI their business needs, not the one their providers know. This strategic approach is not just important; it’s paramount whether to get ahead of the competition or avoid falling behind. AI, particularly in demand forecasting, is the key to staying reassured, well-informed, and confident in your business decisions. By leveraging AI, you can accurately predict future demand, optimize inventory levels, and improve customer satisfaction, providing a solid foundation for future success.

Before determining what the business needs, it is crucial to understand what ‘the business’ truly is. We need to pause and reflect on the keys to the Retail and Consumer Packaged Goods universe. Let’s delve into the essence of the business, as this understanding will serve as the foundation for our strategic decisions and ensure they are well-informed. This focus will keep us clear about the task at hand.

What the business is

If we take a step backward, we can revisit the big-picture basics.

All companies have a mission and three elements in common:

- They need to generate profit through revenue or sales.

- They need to minimize the operating costs and losses to be as competitive as possible.

- They need to differentiate themselves from their competitors.

The Profit and Loss balance is relatively straightforward to calculate: the more you sell, the more revenue you get, and the less you expend on production and distribution, the lower your costs. Meanwhile, differentiating from the competition is much more strenuous to achieve and measure.

In Retail and Consumer Packaged Goods (CPG) businesses, the supply chain is the critical process or set of processes that define the company’s strength. The main difference between Retail and CPG companies is that CPG are more wholesale-oriented good producers that do not retail.

There are three main types of retail companies, each with their unique characteristics.

- Distribution-only retailers that purchase goods from different suppliers and then distribute and sell them along their chains. Distributors such as Carrefour or Walmart fit this category.

- Production and Distribution retailers that produce the goods and distribute and sell them through their selected channels. Fashion companies like Inditex, H&M, or GAP are in this category.

- Finally, hybrid retailers produce their products or have exclusive distribution rights for their white labels but also distribute third-party products. Amazon fits this model.

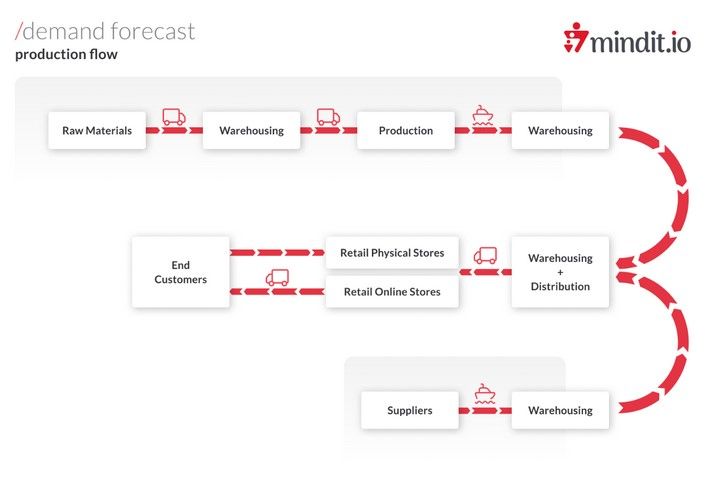

CPG companies have supply chains like Production and Distribution retailers and rely on third parties for the retail part of the process. Therefore, they are suppliers to the Retail sector. Although we will not focus on them, all the contents of this article also apply to them.

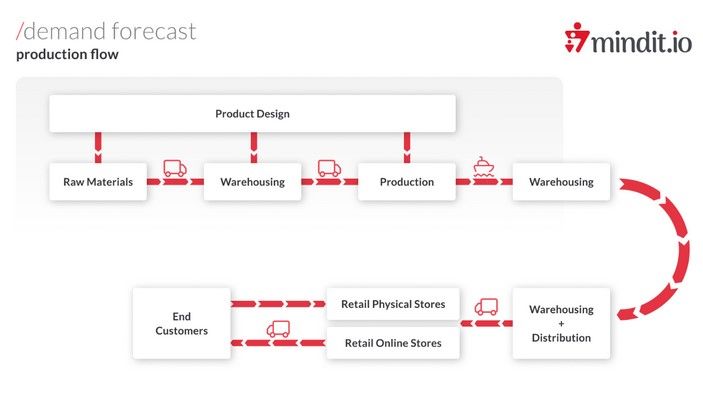

The value chain of retailers who are also producers is the most complex. It begins chronologically with the product’s design and the production process (either internal or outsourced). Once the design is approved, the raw materials are procured. The raw materials must be taken to the production facilities to be turned into the finished goods to be distributed.

Here is where producer and distributor retailers converge. Once distributor retailers have designed their catalogs and decided to distribute a product, they must acquire and distribute it smartly through the available channels and locations.

There are two main channels. One is the Physical Stores. They must be designed attractively and located in accessible, adequate geographical locations, preferably with ongoing passers-by who would eventually stop and purchase some goods or in zones with expected high demand and as few competitors as possible. The problem with physical stores is that they have the burden of attracting customers physically. Each store may have a different set of available products, as it is a common practice to change the available products according to many variables, including local regulations and specific demand.

The other main channel, Online Stores, arrived as a disruptor along with the internet. They are much more flexible and much less costly for the retailer. They are much more comfortable for the user that can purchase anything from the sofa at home, from the mobile anywhere… In this case, the burden on the retailer is the last-mile challenge: delivering the goods to the customers’ homes. The inverse logistic for returns also plays a part. Inevitably, there is nothing perfect. All options come with ups and downs. Online interactions may provide thousands of insights that are not easy to get from the store interactions: which products get more attention, which have a higher conversion rate (visit to purchase), and which ones have a lower one… That data can also be enormously valuable in predicting the future demand for the portfolio product.

In summary, there is a linear dependence between the different steps of the value chain, in any case, with more impact for the companies self-producing all or part of the products they distribute.

Despite this linearity, a significant problem arises from the needs of the decision-making process. Designing, producing, or acquiring a great product to distribute is essential. But if nobody buys it, we will be in trouble. Deep trouble. Unsellable products cost money everywhere: occupying space in stores and warehouses… If we must reduce the price below the production/acquisition price, each product sold will result in a net loss. These are the retailer’s worst nightmares. And the most considerable difficulty is that the solution is at the end of the value chain: the customers.

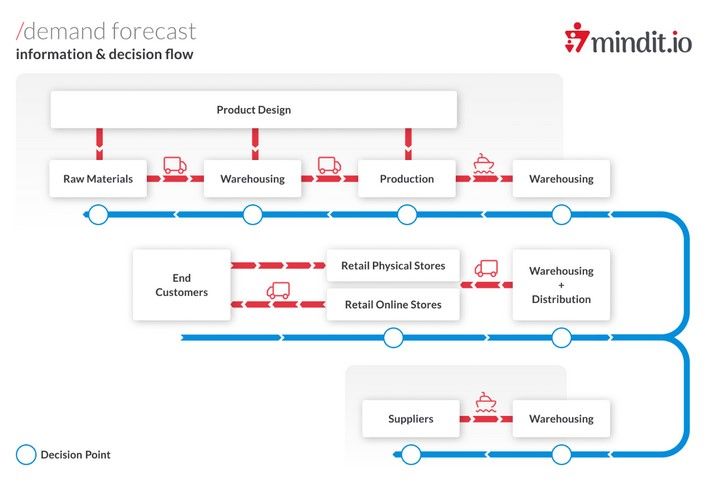

Deciding what to buy/produce begins by knowing what customers will demand.

The inverse information flow for decision-making

The paradox is that the information distinguishing between success and failure is in the customer’s hands. Well, in their buying behavior. If we cannot predict the demand, the process requires a lot of money to be spent before gathering information from them. Does it? Enter Demand Forecasting.

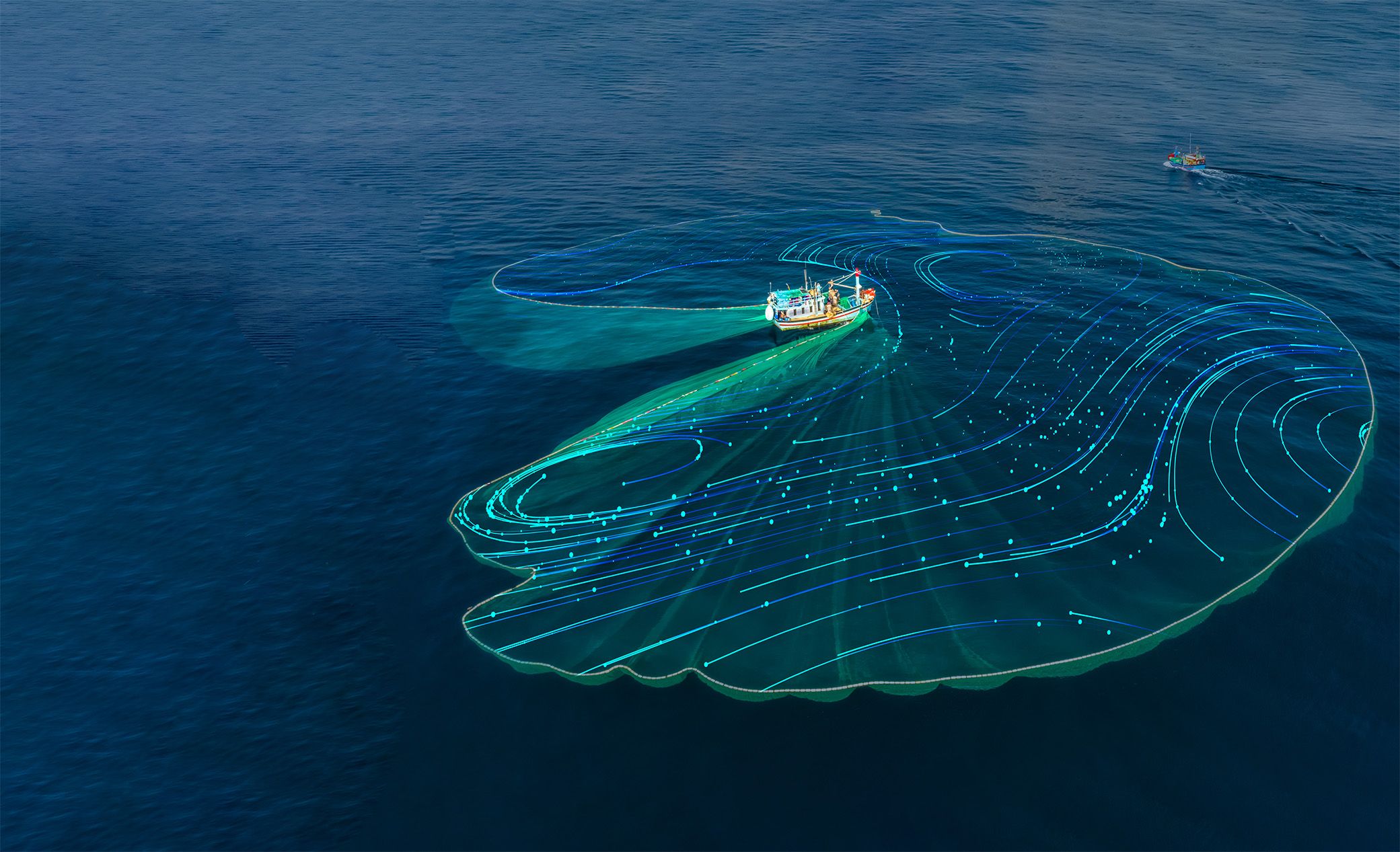

The information required to optimize our value chain begins at the end of the chain: the customer. Imagine if we could predict our customers’ behavior.

What they will buy.

Where they will buy it.

When will they buy it.

With that predicted information, which we call Demand Forecast, we can make the wisest decisions all along the value chain:

- optimize the product flow to the stores, both physical and online,

- streamline warehousing and distribution logistics,

- order the right products at the right time,

- anticipate the success of new products and

- anticipate the end of the lifecycle of existing products in the catalog.

Even more valuable is the information for the self-producers, who can use it to

- design more desirable and demanded new products,

- optimize the acquisition of raw materials by leveraging the market trends and

- minimize stock while maximizing sales.

Being able to anticipate the future (even if it is approximate) is vital in the retail sector. Although essential in all industries, it is specifically critical in the retail world due to the demand-dependence of the whole business model.

What the business needs: anticipating the future

How many movies or TV shows have you seen where somebody comes from the future with privileged information and tries to become rich by exploiting that privileged information? Sometimes, it is just what the time traveler knows. Sometimes, it is a newspaper from the future or an almanac with lots of data that can be used to bet safely or buy/sell the right stocks at the right time.

Let’s take a more realistic approach: had the world known that a global pandemic was coming, many people would have started making masks, vaccines, and other relevant investments much earlier, trying to take advantage of the situation or at least try to reduce its adverse outcomes. Predicting what is coming allows us to anticipate it through our actions.

In March 2021, the Suez Canal was blocked for six days by a container ship 400-meter long1. The chaos and overwhelming disruption of logistic routes impacted many sectors, with particular emphasis on Retail and Consumer Goods.

Anticipating such extraordinary events without information from the future is impossible. However, only some events that impact our businesses are possible to anticipate or at least have some probability of occurrence. While anticipating extraordinary events is impossible, predicting the market behavior after the event can provide the means for a much faster recovery from the “disaster” or business disruption, whatever you may call it.

Our customers’ everyday actions are motivated and directed by different causes. Stormy weather may increase the sales of some products and reduce the interest in others. An increase in the prices of fossil fuels may increase the demand for renewable sources. A sunny day will increase solar energy production.

Therefore, looking at the data available today, both internal (sales, production, costs, among others) and external (competitor’s pricing, market events, new products, weather conditions, international sociopolitical events), there is much information that can be gathered to foresee possible futures, and this may help us prepare for such scenarios in advance. Enable smart decisions: the decisions the business needs at each step of the value chain to reduce uncertainty with the power of AI.

AI sees beyond human capabilities.

That is no secret nor overwhelming revelation. AI has the sensibility to detect patterns where humans only see noise. Machines can detect trends before we humans can. The figures might present subtle increases or decreases, masked by other volatile phenomena. Maybe the mystery lies in unexpected changes in the direction of the market’s evolution, almost undetectable by humans… Until it is too late. AI helps us identify seasonal patterns and differentiate them from cyclic patterns.

Also, AI allows specific calculations to be performed at various levels of aggregation: at store level by product (or at product level by store), geographically, by product category, SKUs by warehouse…, and at a relatively low marginal cost.

Time Series have been studied for a long time. The earliest algorithms predate AI as we know it today. Moving Averages, Exponential Smoothing, Autoregressive Models (AR), and Autoregressive Moving Averages (ARMA) opened the race toward anticipating the future.

Many other algorithms have emerged since the 1950s, creating a sub-discipline of machine learning known as Temporal Series Forecasting. Like many AI sub-disciplines, this one has been revolutionized by Deep Learning and its Neural Networks.

One could think that this fast evolution of the state of the art is making everything more straightforward. But… That might not be the case.

Older algorithms may be weaker in terms of precision/accuracy. However, they will likely be much less computationally costly and more explainable than deep learning algorithms.

For those who do not know it, explainability is the property of an AI model that reveals why a particular outcome has been provided in terms that are understandable to a human being. Why is this important? In decision-making, if the market demand is going to decrease, it will make the most difference to know if it is because of an anticipated economic depression or the obsolescence of our products. The reaction of the company to both scenarios is entirely different. While the reaction to an economic depression will be an increase in low-budget products, the response to the lack of appeal of our products may be to upgrade our catalog even with more expensive and quality products. Identical prediction, different cause. Different decision. Different action.

Once you have insights and suggestions about what will happen next, it is possible to set alarms to trigger decisions: reduce or increase the production or the orders of such products, favor specific designs for the forthcoming products, or even remove certain products from the catalog. With smarter decisions along the value chain, we manage to impact the three levels of the company positively:

- Reduce costs

- Increase sales (and revenue)

- And provide a better and differentiated experience to our customers

A better and differentiated experience

I anticipated that this was the most troublesome benefit to calculate. But despite this, it is intuitive to think of how customers will better perceive your company.

How would you feel if the store closer to your home or work always had what you needed when needed? No shortage of umbrellas on the ‘surprise’ rainy day. No shortages.

How would you react if “your” store offered more competitive prices because it does not need to compensate for obsolete stock, long-storage costs, or inefficient distribution-related costs?

Apart from those advantages, your company may benefit from an exemplary reduction in carbon footprint, attracting new environmentally concerned consumers. In some regions, the carbon footprint is also a variable that might impact your company’s capability to access credit2 in many EU countries.

It can’t be that easy.

True. There are plenty of potential predicaments we are likely to find in our stumbling path. Finding the right team or partner is essential to ensuring the success of any project in developing demand forecasting systems. An experienced team will provide a positive edge by managing the challenges that will arise in the best possible way.

The biggest challenge of all AI projects is excessive hype. Inflated expectations are a common enemy of all innovative technologies, particularly AI. It is essential to understand precisely the possibilities of such algorithms and keep everybody’s feet on the ground.

There are other complications or adversities common to Demand Forecasting solutions. To cite the top three:

- Selecting the input variables. Not all data is relevant. Not all relevant data is readily available. Specific internal data produced and stored in the company’s systems might be crucial. E.g., Prices or Sales by store. However, data from external sources will also play a fundamental role in future demand behavior. We have already given some examples: weather forecasts or competitor prices. It requires skill and experience, after gathering and cleaning the data, to select the most relevant variables for the desired outcome and even identify which additional variables are needed and which available ones are superfluous.

- Selecting the most suitable algorithm. The most recent algorithm isn’t always the best one. It might not be the most mature, explainable, or cost-efficient for the use case. An experienced team will pre-select the most appropriate models a priori. Then, they will be implemented and evaluated for accuracy in the selected metrics, computational cost, and prediction velocity. A suitable algorithm may also depend on the input variables and their properties.

These two selections are highly interdependent. And often, they must be worked iteratively: variables -> new model -> new variables -> new models ->

Finally, the last factor to consider is the productization of the system. This includes many aspects to account for:

- Integration with the company’s IT ecosystem, including SSO.

- Implementation of the data pipelines.

- Setting up an efficient MLOps backbone.

- Setting up how the users will ‘consume’ the predictions provided by the models, usually a dashboard with a diverse range of detailed graphic visualizations.

- It is also imperative to define how the accuracy of the models will be measured and

- how the system will be maintained, evolved, and retrained when the business requires it.

Conclusion

It is a beautiful moment to consider empowering retail businesses with the tools to make the best decisions possible. Even if your Time Series Forecasting algorithms are not up to date or nonexistent, the incredibly mature state of the art of this technology makes it a no-brainer to move toward a smarter operation paradigm.

Your business (and all businesses) needs to streamline the end-to-end core process from production/procurement to the end customer, maximizing profits while minimizing costs. This will give your company an unexpected boost in branding and image. Demand Forecasting is the right place to start building the company’s future on solid ground.

Find a trustworthy and experienced partner who will work with your business and technical teams to design and implement the approach, solution, and implementation from a PoC to a full-scale solution. This will not be free of challenges.

- Identifying the relevant input variables.

- Selecting and testing the most appropriate algorithms according to the acceptable accuracy and costs.

- Putting the solution in production efficiently, with the right visualization dashboards and a solid MLOps backbone.

You no longer have to travel to the future to know what your clients will demand.

Just predict it.

mindit.io has developed a unique approach to Demand Forecasting, distinguished by its brilliant, progressive, and highly customized approach. Following the best practices shared by most AI experts, it offers the best of both worlds: a standard phased introduction to Demand Forecasting that allows your company to think big but start small and iterate to scale your solution—a fast track to safe results.